Information Disclosure based on

the TCFD recommendations

The scope and extent of the impact of climate change on the global environment and civic life are expanding, such as frequent and severe storm and flood damage and destabilization of energy markets. The role that companies should play in mitigating and adapting to climate change is becoming increasingly important, and we consider climate change to be an important social issue.

Decarbonization/carbon neutral initiatives are being quickly rolled out by our customers and in markets as well. As the demand for semiconductors, which are indispensable for conversion to new clean energy and higher efficiency of energy use, is expected to increase, we hope to further contribute to the decarbonization of the market and society through our technologies and products.

Based on this recognition and thought, we believe that meaningful dialogue is important with our stakeholders regarding the impact of climate change-related risks and opportunities connected to our business, strategy, and finance, and disclose our system and initiatives based on the TCFD recommendations.

Governance

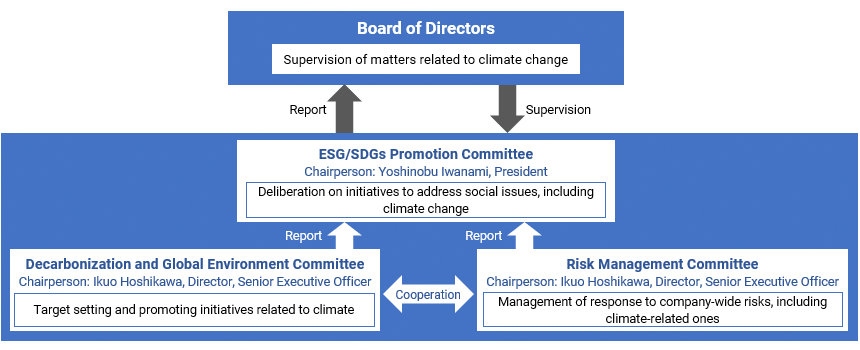

Basic policies and matters of importance related to climate change are deliberated and decided by the ESG/SDGs Promotion Committee, a decision-making body for social issues that we address, and related information is regularly reported to the Board of Directors. In this way, we have a governance system in place to ensure proper supervision by the Board of Directors.

The Decarbonization and Global Environment Committee is responsible for all of our climate change initiatives from the perspective of climate change, such as formulation of policies and targets related to climate change and development of business strategies, and reports information about target achievement progress status to the ESG/SDGs Promotion Committee in a timely manner.

Risk management

Climate-related risks and opportunities that may affect our business, strategy, and finance are identified and assessed mainly by the Decarbonization and Global Environment Committee. Identified climate-related risks and opportunities are assessed from the aspects of “degree of impact,” “timing of manifestation/realization,” and “possibility of manifestation/realization” with reference to external information such as climate change scenarios. Taking these into comprehensive consideration, material risks and opportunities are subsequently identified.

The identified material risks and opportunities are integrated into company-wide risks as necessary through cooperation and discussions between the Risk Management Committee, which supervises risk management of the Company, and the Decarbonization/Global Environment Committee. The Risk Management Committee reports on the management status of company-wide risks to the ESG/SDGs Promotion Committee in a timely manner.

[Climate Change Governance/Risk Management System]

Strategy

In identifying climate-related risks and opportunities that may affect our business, strategy, and finance, we summarized our views of [1] a world where decarbonization progresses and temperature increase is limited to a range of 1.5°C to 2°C, and [2] a world where global warming progresses with a temperature increase of 3°C to 4°C as a natural consequence. We then extracted and sorted out climate-related drivers in each scenario that are likely to exert a large impact on our company.

[Future World Views and Major Climate-Related Drivers]

| Future world views | [1] 1.5°C - 2°C Scenario (Decarbonized society) | [2] 3°C - 4°C Scenario ("Let it ride" society) | |

|---|---|---|---|

| A scenario in which social changes associated with the transition to a decarbonized society affect our business | A scenario in which climate change mitigation measures turn out to be unsuccessful, allowing global warming to progress as a natural consequence and affect our business | ||

| Ambitious policies and innovation of environmental technologies can be implemented to control the average temperature increase before the end of this century to between 1.5°C and 2°C and to achieve sustainable development. | Although each country implements policies to achieve its target in line with the Paris Agreement, international cooperation, environmental technology development, energy conversion, etc. turn out to be insufficient, and the average temperature increase until the end of this century will be approx. between 3°C and 4°C. | ||

| Major climate-related drivers | Policies / Regulations | •Global carbon pricing and carbon price increase | •Carbon price remains low |

| Market | •Spread of autonomous driving •Increase in demand for semiconductors in conjunction with advances in communication and information processing technologies |

||

| •Energy source conversion from fossil fuels to clean energy •Shift of energy mix to "renewable energy plus nuclear power” •Progress of EV shift •Soaring prices of highly carbon-intensive raw materials (steel materials, etc.) |

•Continued dependence on fossil fuels, soaring fossil fuel prices •Continued operation of thermal power plants • Continued sales of vehicles equipped with internal combustion engines |

||

| Technology | •Intensifying competition for technological development toward a decarbonized society •Progress in the development of CCUS* technology, increase in CO2 transfer volume |

─ | |

| Changes in weather and climatic, environment | ─ | •Frequent and severe flood damage •Depletion of water resources and deterioration of water quality |

|

*CCUS: Carbon dioxide Capture, Utilization and Storage

In light of the above-stated sorting of world views and drivers, we identified our climate-related risks and opportunities, and assessed them from the aspects of “degree of impact,” “timing of manifestation/realization,” and “possibility of manifestation/realization” with reference to climate change scenarios depicted by the IEA*1, IPCC*2, and other associations. Shown below are summarized material risks and opportunities for us, as well as future schemes and measures to deal with them.

*1 IEA: International Energy Agency

*2 IPCC: Intergovernmental Panel on Climate Change

[Risks]

| Details of risks | Time axis | Measures against risks | |

|---|---|---|---|

| Policies / Regulations | Burden of carbon price according to the amount of GHG emissions of the company | Medium term | Reduction of GHG emissions by promoting energy-saving and energy-creating initiatives |

| Market | Decrease in demand for fluid control equipment in the electricity and energy markets as the use of alternatives to fossil fuels is promoted | Medium to long term | Monitoring trends in energy shifts and EV shifts, and strategic response |

| Decrease in demand for fluid control equipment for vehicles equipped with internal combustion engines | Short to medium term | ||

| Technology | Intensifying competition for technology and product development toward a decarbonized society | Medium term | Acceleration of research and development of technologies and products considering environmental load reduction, such as energy saving, resource saving, and space saving |

| Changes in weather and climatic, environment | Occurrence of floods in and around the company's main business sites | Short term | Promotion of measures for disaster preparedness at high-risk sites, strengthening of cooperation between sites, and review/strengthening of BCP |

[Opportunities]

| Details of opportunities | Time axis | Measures to seize opportunities | |

|---|---|---|---|

| Market | Increase in demand for semiconductor-related products along with the progress in digital transformation (DX), etc. aimed to improve the efficiency of socio-economic activities | Short term | Technological innovation and monitoring trends in the information, communication and control markets, and new product launch in a timely manner |

| Increase in demand for fluid control equipment in the clean energy market, such as hydrogen, ammonia and biomass fuels | Medium to long term | Understanding needs and promoting development in the clean energy fluid market | |

| Increase in demand for semiconductor-related products resulting from increased solar power generation and spread of dispersed power sources | Short term | Stable supply of semiconductor and liquid crystal related products for the electric power market in light of the expansion of the renewable energy market and shift to a dispersed energy society | |

| Increase in demand for semiconductor-related products in conjunction with increase in in-vehicle semiconductors and devices for EVs and self-driving cars | Short term | Understanding needs and promoting market development along with the mobility shift | |

| Technology | Increase in demand for fluid control equipment that contributes to CO2 transportation/transfer and fluid control. | Medium term | Acceleration of R&D until the commercialization of CCUS, participation in verification tests, etc. |

| Changes in weather and climatic, environment | Increase in demand for drainage facility and pump-related products | Short term | Operating business that solves social issues |

| Increase in demand for seawater desalination and water purification related products | Long term |

■Risks/opportunities that are expected to be prominent in the following scenarios

- 1.5°C-2°C Scenario

- 3°C-4°C Scenario

■Time axis (timing of manifestation/realization)

Short term: within 3 years, Medium term: over 3 years and within 10 years, Long term: over 10 years

Going forward, we will steadily implement our measures against climate-related risks, and contribute to the decarbonization of markets and society as well as the improvement of resilience to climate change through technological development and product supply that contribute to mitigation and adaptation to climate change.

Indexes and Targets

[Greenhouse gas emissions]

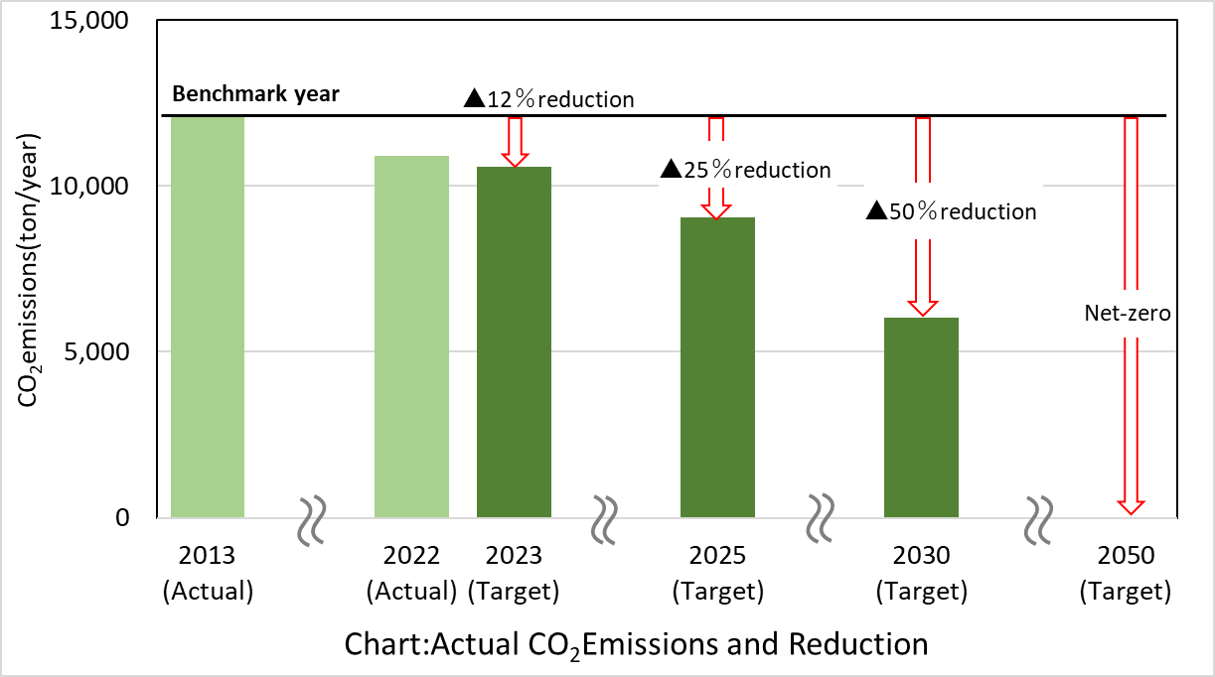

Toward climate change mitigation, the Group is actively working to reduce greenhouse gas emissions through energy-saving activities, private solar power generation on its own site, and other efforts.

In order to continue contributing to the realization of a decarbonized society, we have set the following targets in line with the Paris Agreement and policies established by the Japanese government.

- CO2emissions reduction target (consolidated/Scope 1+2)

- • Long-term target: CO2emissions in FY 2050 “Net-zero”

- • Medium-term target: CO2emissions in FY 2030 to be “reduced by 50%” compared to FY 2013

- • Short-term target: CO2emissions in FY 2025 to be “reduced by 25%” compared to FY 2013

To achieve the above targets, we are committed to further promoting energy-saving activities and introducing clean energy.

[Sales of products that contribute to the realization of a decarbonized society]

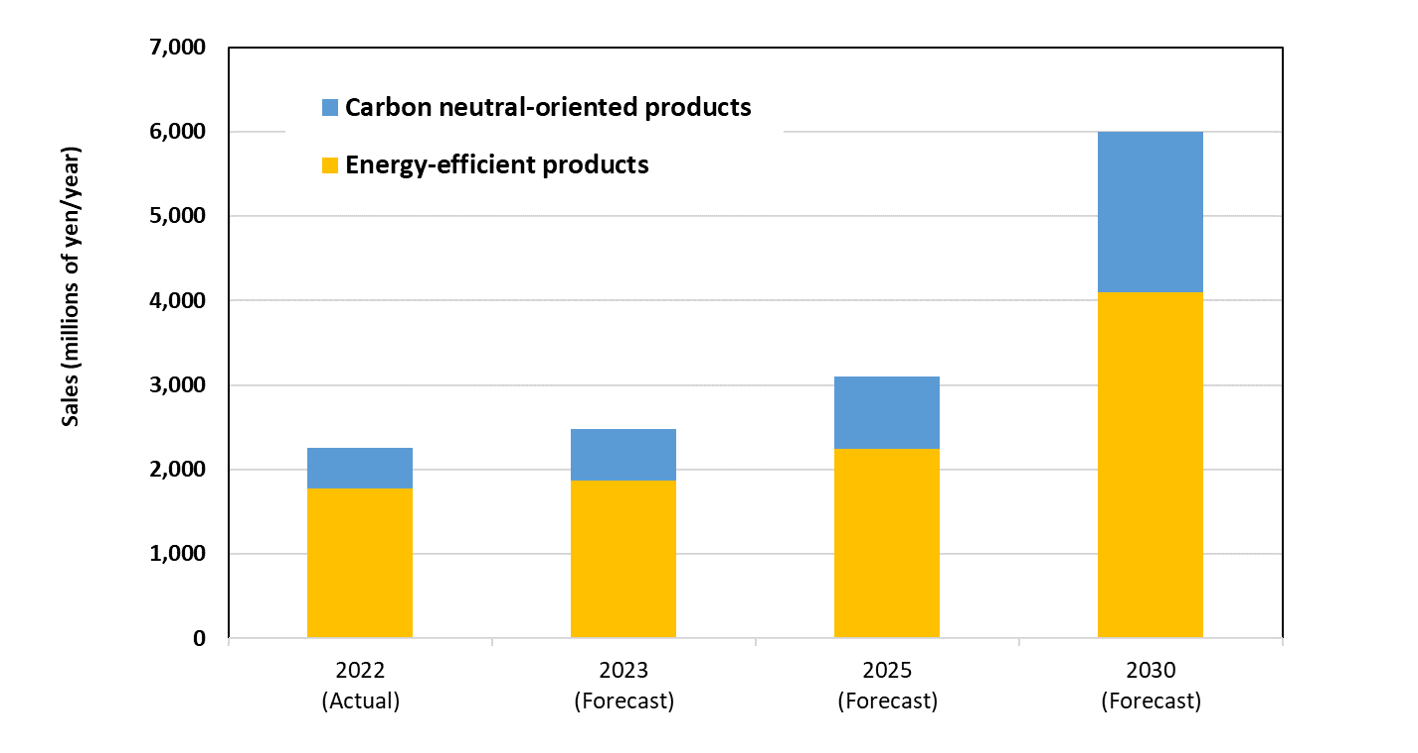

On a mission to “Contributing to the safety and security of society and the environment through the control of a wide range of fluids,” we are contributing to the realization of a decarbonized society by controlling the flow of greenhouse gases and various types of energy resources.

Going forward, in order to meet growing needs for energy saving and utilization of clean energy in business activities of our customers and markets, we have selected:

[1] Energy-saving products (e.g. new fitting “Sweep Elbow” for semiconductor manufacturing equipment)

[2] Carbon neutral-oriented products (e.g. hydrogen power generation seals, EV resin fittings) aiming to expand the scale of sales with the sales of these products set as an index.

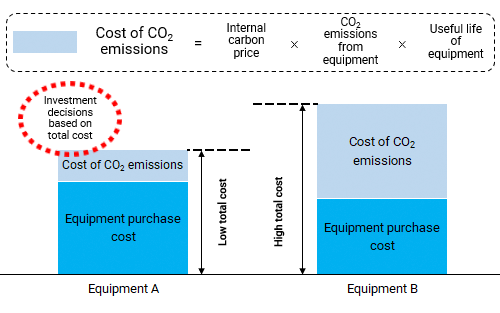

[Internal Carbon Pricing]

We have introduced an Internal Carbon Pricing (ICP) system for investment in businesses, equipment, etc. for the purpose of revitalizing internal discussions aimed at low-carbon products and business activities. Specifically, we have set an internal carbon price of 9,200 yen/t-CO2 (as of October 2021) for our company alone, which is used as one of the investment indexes related to energy saving and energy creation. The internal carbon price will be reviewed in a timely manner in view of trends in carbon price policy.