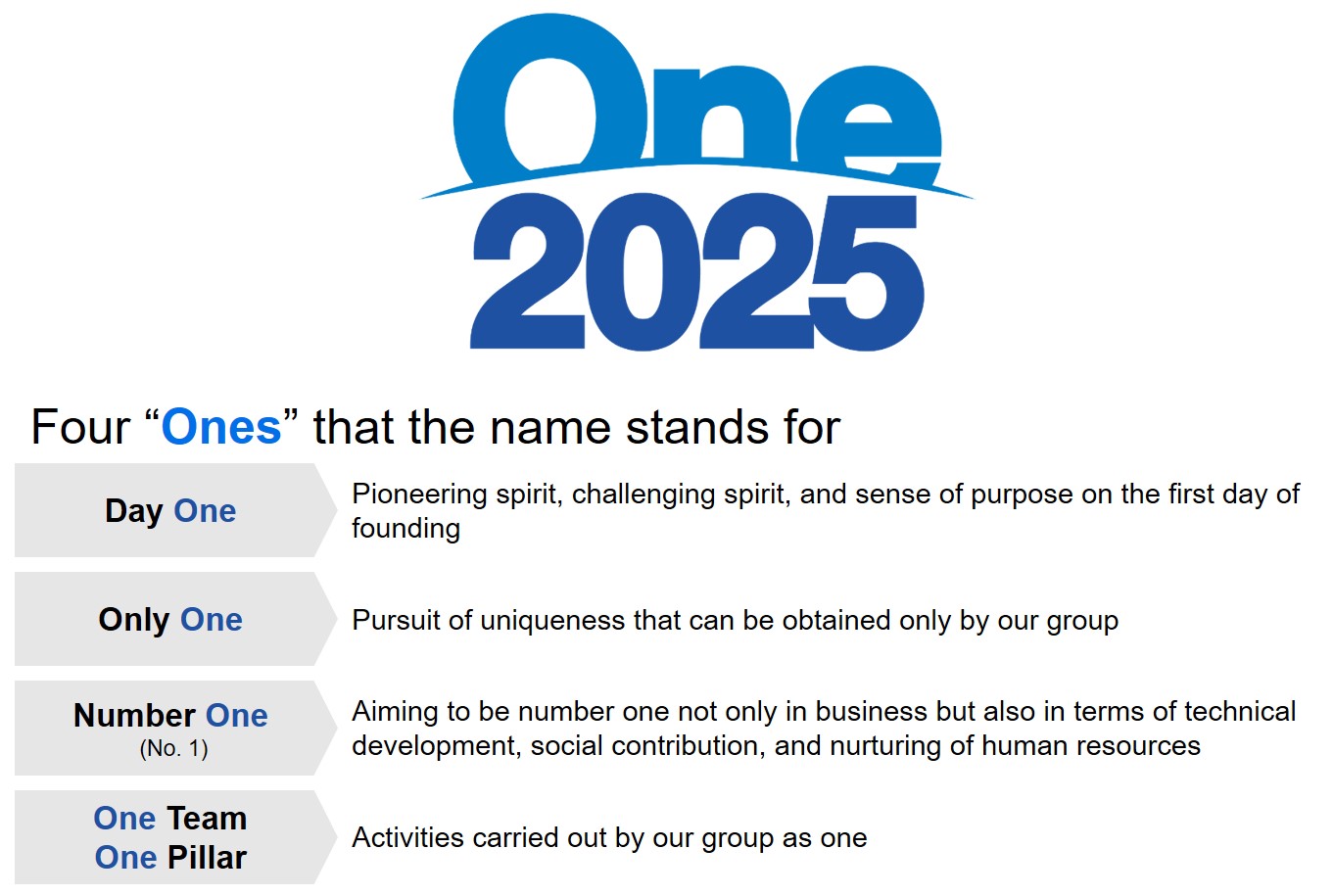

Basic Philosophy

Basic Policies

-

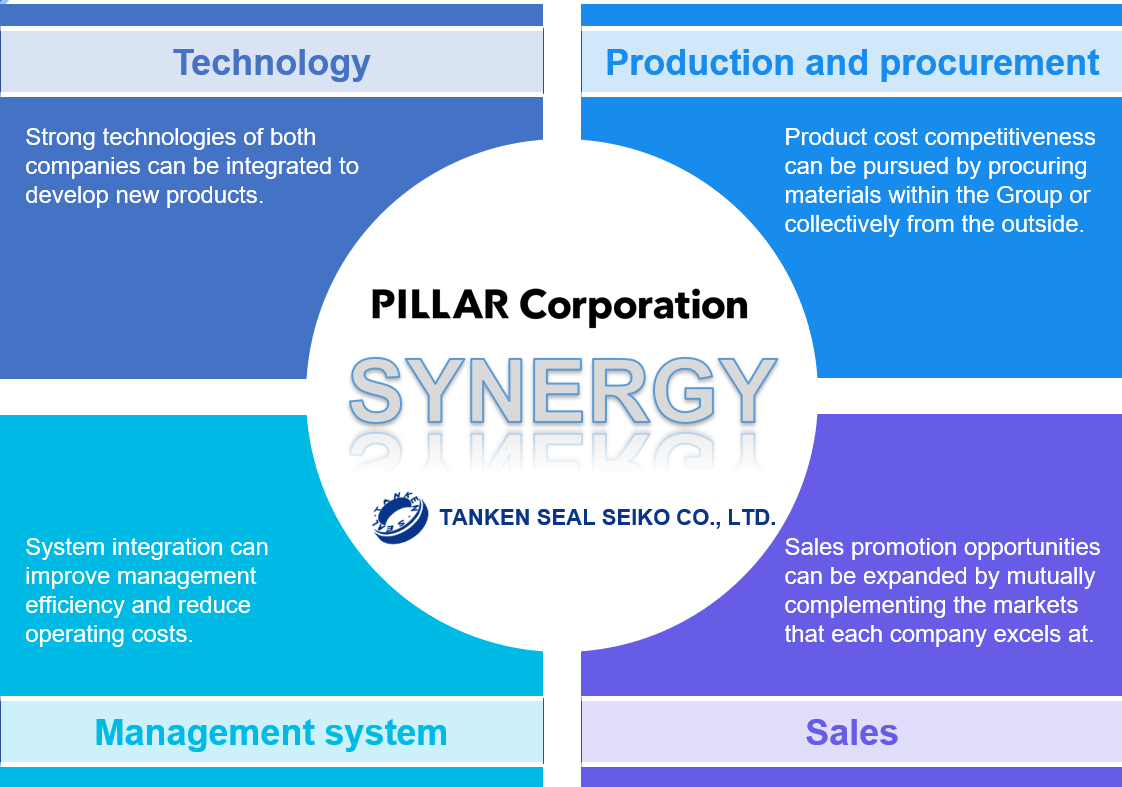

By segment

Electronic equipment business Sales 36,819 36,800 -19 0.05% Operating income 11,759 7,300 -4,459 37.9% Industrial equipment business Sales 11,844 20,700 8,856 74.8% Operating income 2,059 3,000 941 45.7%

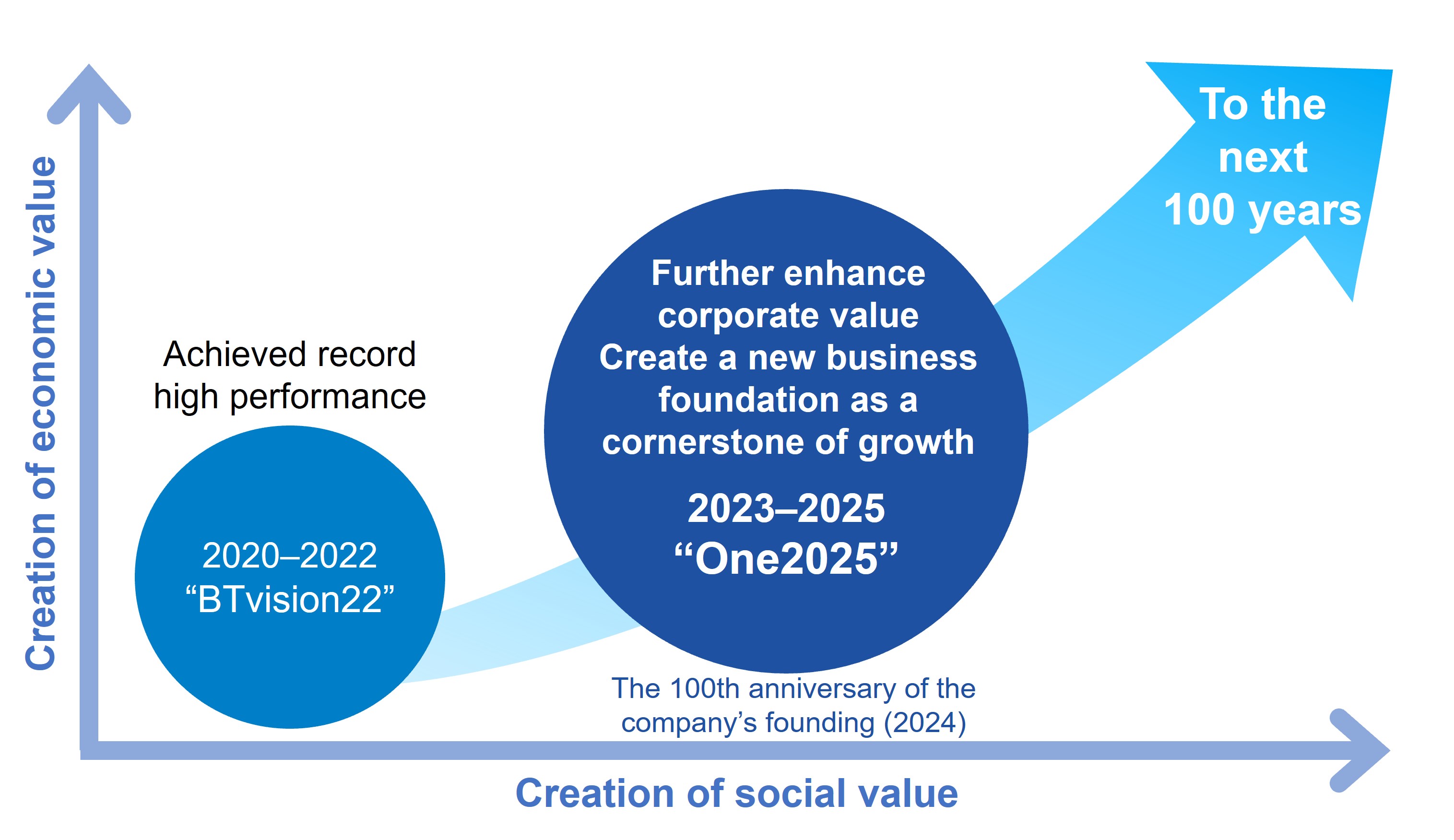

Business Targets

(Unit: Million Yen)| BTvision22 | One2025 | |||

|---|---|---|---|---|

| FY2022 | FY2025 | Increase (Decrease) | Change rate | |

| Results | Target | |||

| Sales | 48,702 | 57,500 | 8,798 | 18.1% |

| Operating income | 13,842 | 10,300 | 3,542 | 25.6% |

| Operating income ratio | 28.4% | 17.9% | -10.5P | ー |

| ROE | 18.6% | 10% or more | ー | ー |

| Payout ratio | 30.0% | 30% or more | ー | ー |

| Growth investment | (3-year cumulative total)3,715 | (3-year cumulative total)29,200 | 25,485 | 686% |

Business Strategies and Measures by Segment

Synergy with TANKEN SEAL SEIKO

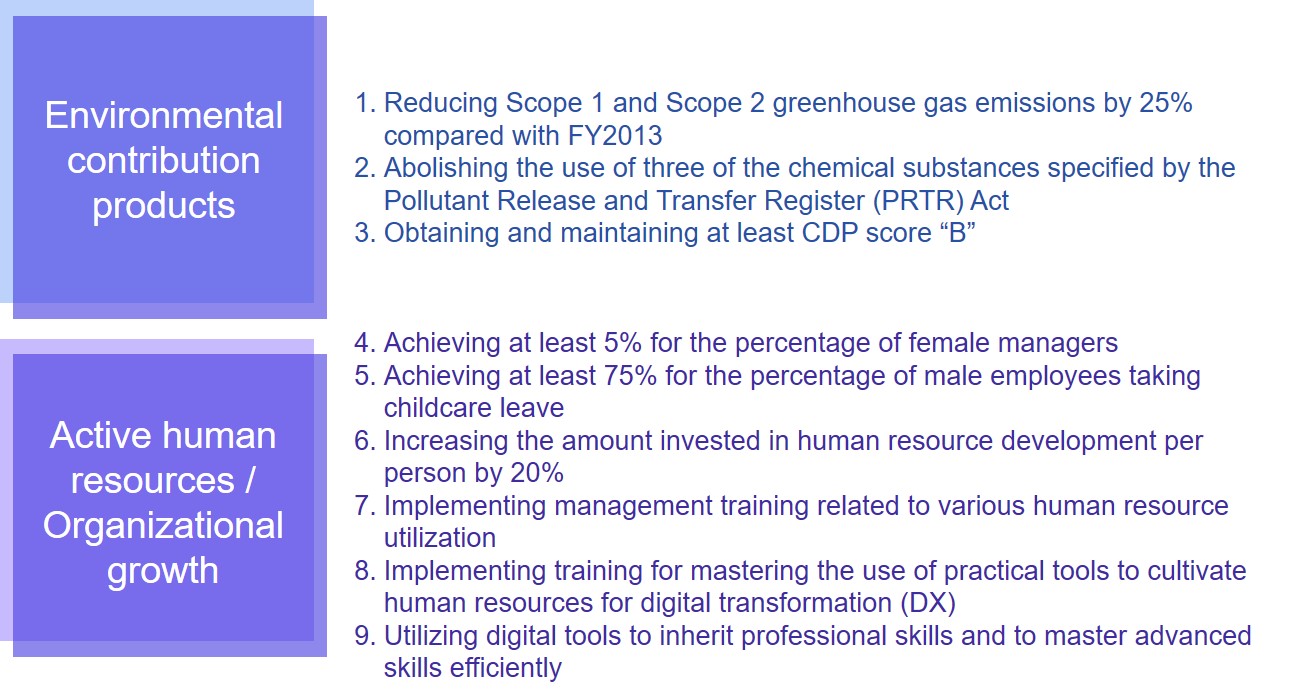

Non-financial Items: Priority Targets

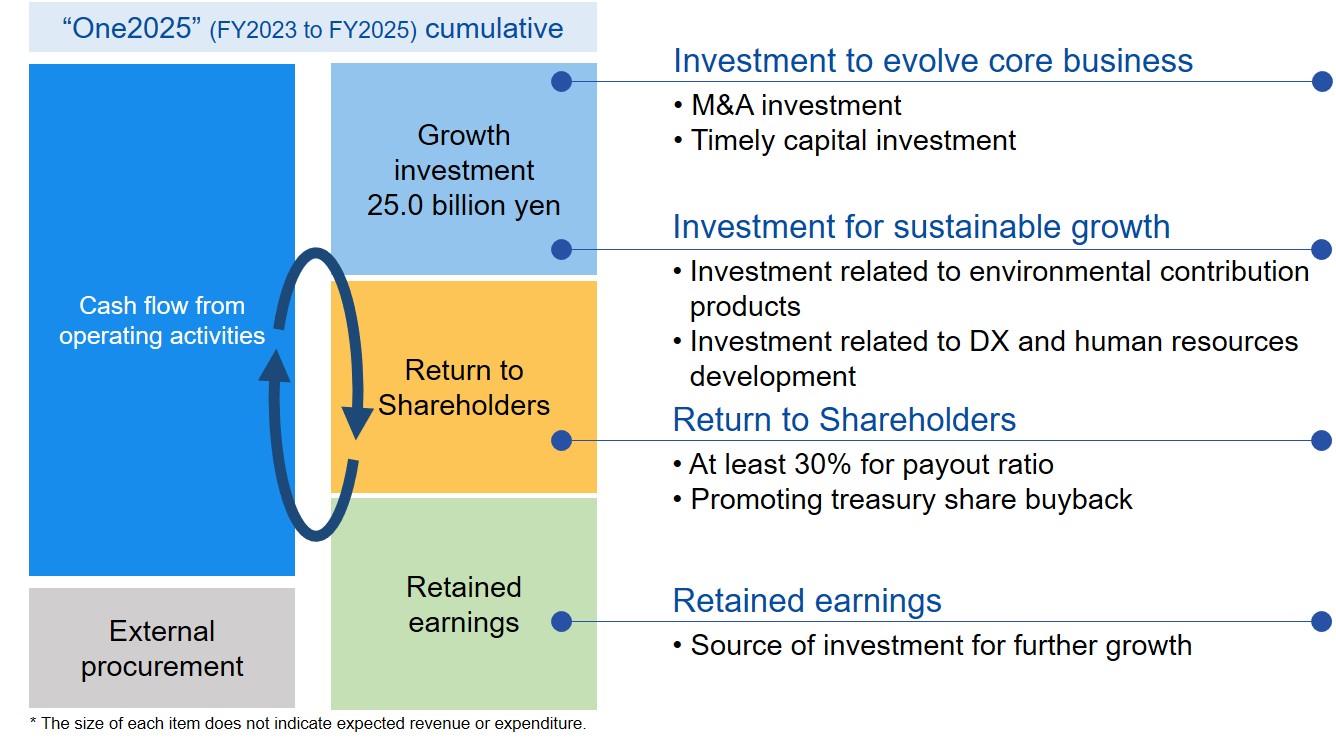

Financial strategy Cash Allocation

Growth investment

Each medium-term Management Plan - Growth investment(Facility,M&A,DX,Workforce,etc.)