Dividend Policy

Dividend Policy

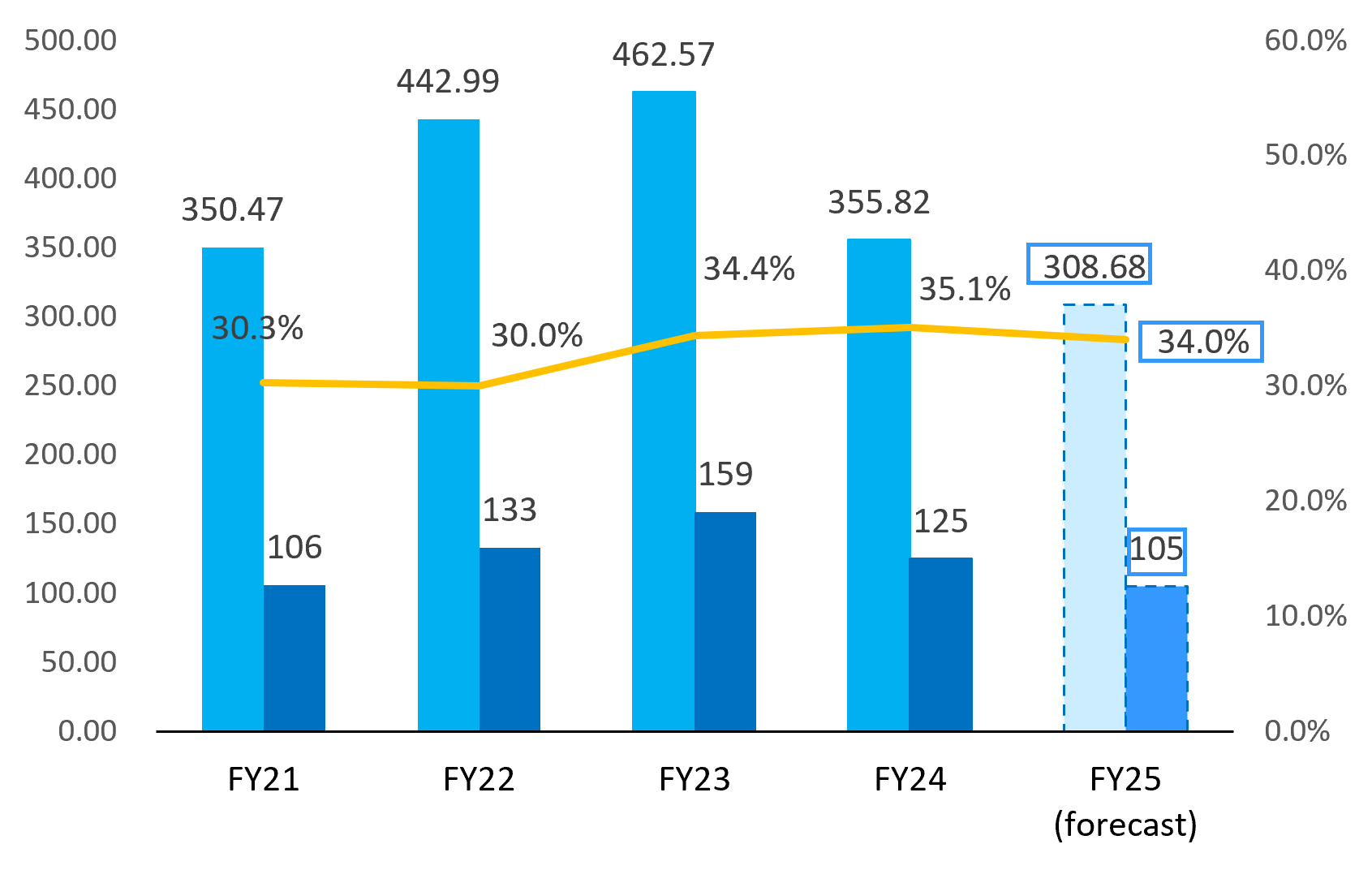

PILLAR Corporation positions shareholder returns as one of the important duties of management and has a basic policy of working to provide a stable, continuing dividend while raising dividend levels. Based on the above policy, we are targeting a payout ratio of 30% or higher for dividends from the fiscal year ending March 2021.

We will effectively utilize internal reserves to strengthen our corporate competitiveness and expand operations, comprehensively considering medium- to long-term capital expenditures, R&D investments, other business expansion, shareholder returns, and so forth.

Shareholder Returns

Profit per share / Dividend / Payout ratio

Shareholder Benefits

| Purpose | The purpose is to thank our shareholders for their continued support and to increase the attractiveness of investing in our stock, and to have more people hold our stock over the medium to long term. | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Outline of Shareholder Benefit Program | 1.Eligible Shareholders Eligible shareholders shall hold 100 or more shares (1 unit) of the Company’s stock listed or recorded in the shareholders’ register as of March 31 of each year. |

|||||||||||||||||

| 2.Shareholder Benefits QUO Cards will be presented to eligible shareholders. |

||||||||||||||||||

(Note) Holding for more than three years means that the same shareholder number is listed or recorded seven or more consecutive times in the shareholders’ register as of the last day of March and September of each year. |

||||||||||||||||||

| 3.Date of Gift The gift is scheduled to be sent out in late June after the Annual General Meeting of Shareholders. |